I’m no economist and I did not stay at a Holiday Inn Express last night, so I make no claims to be gifted in predicting the future. After all, I smugly opined on the day that Donald Trump announced his candidacy for the presidency that he would crash and burn within six weeks. He may yet crash and burn but it’s taken a tad longer.

But it doesn’t take a crystal ball to see a repeat of the 2008 financial collapse and when it happens, don’t forget to thank Louisiana’s two senators and four of our six representatives. I mean, Stevie Wonder can see the idiocy of the actions of Congress in rolling back the reforms put in place by the DODD-FRANK rules following the disastrous Great Recession brought on by the recklessness of the banking industry.

The HOUSE voted 258-159 on Tuesday to allow banks with up to $250 billion in assets (that’s roughly eight times the size of Louisiana’s $30 billion budget and our legislators can’t even get a grasp on that) to avoid supervision from the Fed and STRESS TESTS. Under Dodd-Frank, the tougher rules applied to banks with at least $50 billion in assets.

Louisiana House members who voted in favor were Garrett Graves, Mike Johnson, Ralph Abraham, and Steve Scalise. Only Rep. Cedric Richmond voted against the measure while Paramilitary Macho-Man, the Cajun John Wayne, Clay Higgins took a powder and did not vote.

The measure, S-2155, had eased through the SENATE by a 67-31 vote back on March 14 and both Louisiana Sens. Bill Cassidy and John Kennedy voted in favor. Kennedy, who loves to preach about revenue and spending, should know better: he was Louisiana State Treasurer for eight years, from 2000 to 2008. You’d think he might have learned something during that time. Guess not. But what could you expect from someone who thought he had “reduced paperwork for small businesses by 150 percent” during his tenure as Secretary of Revenue?

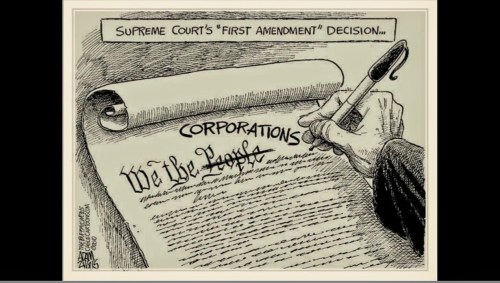

You can be sure that the banking industry lobbied Congress hard for this. Their lobbyists may well have outnumbered—and outspent—the NRA and perhaps even big oil and big pharma in its efforts to show members the right thing for baseball, apple pie and the American Way. Here is a blurb from the Arkansas Banking Association to its members on Monday, the day before the House vote, for example:

ABA (the American Banking Association) is asking all bankers to make a final grassroots push by calling their representatives and urging them to vote “yes” on S. 2155. ABA and all 52 state bankers’ associations sent letters to the House on Friday urging passage of S. 2155. Take action now.

Here is a copy of the ABA LETTER to House Speaker Paul Ryan and Minority Leader Nancy Pelosi and the letter sent by the state ASSOCIATIONS, including the Louisiana Bankers’ Association.

It’s almost as if the bankers, their lobbyists and their pawns in Congress have had their collective memories erased.

Remember “TOO-BIG-TO-FAIL” or costs of somewhere in the neighborhood of $14 TRILLION (with a “T”) to the U.S. economy the last time banks got a little carried away with their subprime mortgages and insane investments of OPM (other people’s money)? Remember how the runaway train wreck of 2008 darned-near destroyed the economy not just of this country, but the entire GLOBAL ECONOMY?

Remember how Congress had to bail out the incredibly reckless banks and how not a single person ever did jail time for the manner in which greed and more greed took over for sound fiscal judgment?

Remember the run-up to the 2008 collapse? Deregulation? Warren Buffet’s referring to derivatives as “financial weapons of mass destruction” (was anyone listening)? Enron? Worldcom? Countrywide? Merrill Lynch? Wells Fargo’s manipulation of customers’ accounts? Lincoln Savings & Loan? Pacific Gas and Electric? Arthur Anderson? Lehman Brothers? Bear Stearns? AIG? Washington Mutual?

Did anyone learn a damned thing? Judging from the rollback of Dodd-Frank, the answer to that critical question must be a resounding “NO.”

And lest you feel a pang of sympathy for those poor, over-regulated banks, consider this: PROFITS for AMERICAN BANKS during the first quarter of 2018 increased by 28 percent, shattering the prior record set just three quarters earlier.

The “blockbuster earnings report” was attributed to tax cuts implemented by the Trump administration, which should give you a pretty good idea about just who the tax bill was designed to help in the first place.

And here’s something that will give you a warm fuzzy: American banks are sitting on almost $2 trillion of capital that will help them survive the next recession—whether you get through the next downturn or not. That theory that excess capital would be plowed back into the economy just didn’t seem to pan out. Wall Street is counting on the Dodd-Frank deregulation allowing banks to return as much of that surplus cash as $53 billion back to SHAREHOLDERS.

Reinvestment? More jobs? Stimulating the economy? Fuggedaboutit.

It’s all about the shareholders.

Always has been, always will be.

And you can bet the shareholders won’t fuggedaboutit when it comes to chipping into the campaign coffers of those members of Congress who had the good sense to vote to lift the unreasonable burden of overregulation off the poor, struggling banking industry.

But what the hell? I’m not an economist. I’m just one of those purveyors of all that fake news.