In case you’ve ever taken the time to wonder why our legislature has been unable—or unwilling—to effective address the looming fiscal crisis for the state, here’s a quick lesson in civics that may help you understand the real priorities of our elected officials and the forces that motivate them.

Members of Congress are advised to spend four hours per day FUNDRAISING, or on “call time.” That’s time to be spent on the telephone raising campaign contributions—if they want to be re-elected.

They are also told they should spend one to two hours on “constituent visits,” which often translates to meeting with lobbyists and campaign contributors. That leaves two hours for committee meetings and floor attendance, one hour for something called “strategic outreach,” or breakfasts, meet and greets, press interviews (read: Sen. John Kennedy), and one hour “recharge time.”

It doesn’t take a mathematician to see that we’re paying big salaries for these guys to actually work only about two hours per day for only part of the year.

Another way of putting it is we’re paying big bucks for them to spend twice as much time raising campaign contributions as actually doing the work of the people who, in theory at least, elected them.

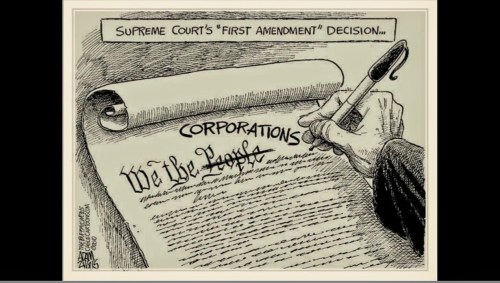

That’s in theory only, of course. The truth is special interests such as banks, hedge funds, big oil, big pharma, the military-industrial complex, the NRA, and other major corporate interests—especially since the Supreme Court’s Citizens United decision—turn the gears of democracy while letting the American middle class delude itself into thinking we actually affect the outcome of elections.

Now, take that image and move it down to the state level and you have a microcosm of Congress.

The numbers are smaller, of course, given the smaller House and Senate districts from which candidates run but the model is the same.

And that is precisely the reason nothing gets done in regard to resolving the financial plight of the state.

Corporate tax breaks, tax exemptions, and tax credits have eroded the state budget until the onus now falls on the individual taxpayers while companies like Walmart enjoy Enterprise Zone tax credits for locating stores in upscale communities across the state.

Petro-chemical plans along the Mississippi River and in the southwestern part of the state enjoy millions of dollars in tax breaks for construction projects that produce few, if any, new permanent jobs.

And who is front and center in protecting the interests of these corporations?

That would be the Louisiana Association of Business and Industry (LABI), first created with the intent of breaking the stranglehold of organized labor back in the 1970s and now focused on maintaining lucrative tax incentives for its membership.

LABI has four primary political action committees: East PAC, West PAC, North PAC, and South PAC.

LouisianaVoice has pulled the contributions of LABI, its four PACs.

For lagniappe, we’ve also thrown in contributions from pharmaceutical and oil and gas interests. The latter list offers a clear-cut explanation of why efforts to hold oil and gas companies accountable for damage to Louisiana’s coastal marshland have died early deaths.

You will notice in reviewing the reports that LABI, while making individual contributions, pours most of its money into its four PACs, which then make the direct contributions to the candidates.

Enjoy.